Let’s start by discussing exactly how to complete IRS Form 4136.

Please note: this article was written for educational purposes only. This should not be considered as tax advice or legal advice. Please consult with your tax professional for technical questions.

We’ll go step by step through each line of this form. Odds are highly unlikely that a single taxpayer will use every line in this form.

Note: The images used here are from the 2021 version of this tax form. At the time of print, the 2022 tax form was available in draft form only. There appear to be a few minor changes from 2021 to 2022. These changes will be pointed out in the respective line.

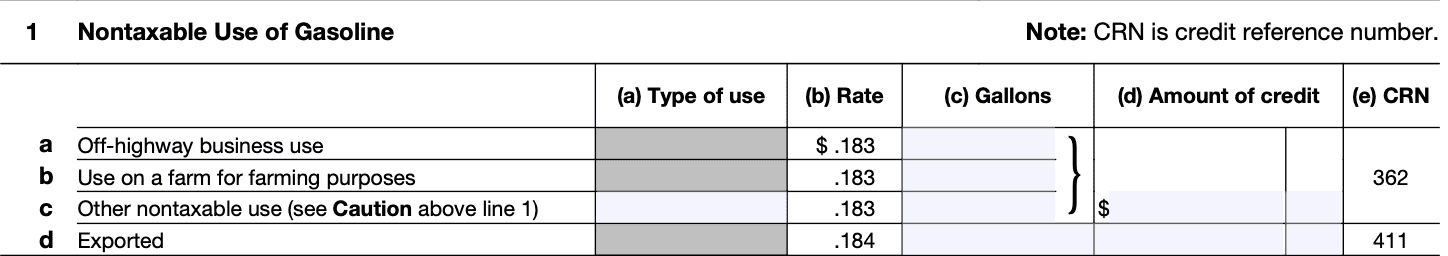

Generally, the ultimate purchaser is the only entity who can claim a tax credit on business use of gasoline.

A taxpayer may only take a tax deduction for gasoline consumed for business purposes, not for personal purposes. Also, for Lines 1a and 1c, a taxpayer may not make any claim for gasoline used in a motorboat, unless used in commercial fishing (Type of Use 4, above).

For each use, enter the following:

Additionally, there are only certain uses that qualify for a tax credit:

For Line 1a, the gasoline must have been used during the period of claim for a business use other than in a highway motor vehicle registered (or required to be registered) for highway use (type of use 2).

An example might be gasoline used in the operation of a landscaping business.

For Line 1b, the gasoline must have been used during the period of claim on a farm for farming purposes (type of use 1).

For Line 1c, the gasoline must have been used during the income tax year for one of the following types of use:

For type of use 13 or 14, the claimant must not have waived the right to make a claim. If the ultimate purchaser waived their right to make a claim, then the registered ultimate vendor may make the claim.

For Line 1d, the gasoline must have been exported during the period of claim (type of use 3). Taxpayers making a claim for exported taxable fuel must keep proof of exportation with their records. Proof of exportation includes one of the following:

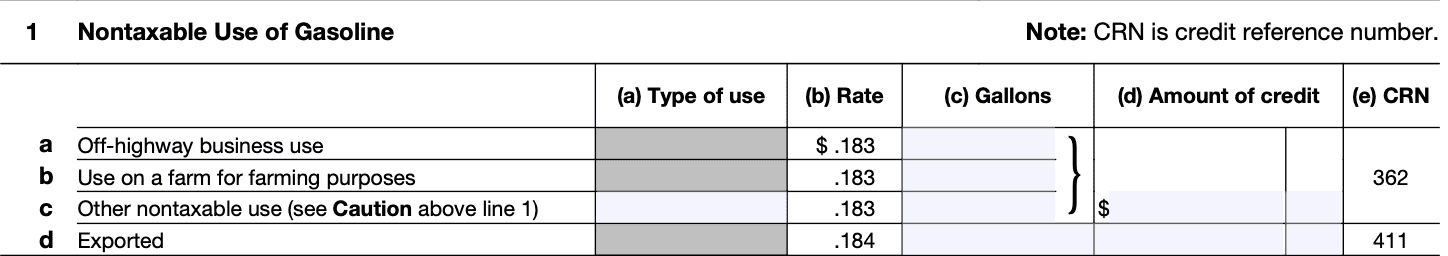

Generally, the ultimate purchaser is the only entity who can claim a tax credit on business use of gasoline.

For each use, enter the following:

In Line 2b, the aviation gasoline must have been used during the period of claim for one of the following types of use:

For type of use 13 or 14, the claimant must not have waived the right to make a claim.

Use Line 2b to make a claim for aviation gasoline used outside the propulsion system of an aircraft.

For Line 2c, the taxpayer must have exported the aviation gasoline during the period of claim.

For Line 2d, the taxpayer must have used the aviation fuel in foreign trade to claim a credit for the LUST tax paid (type of use 9).

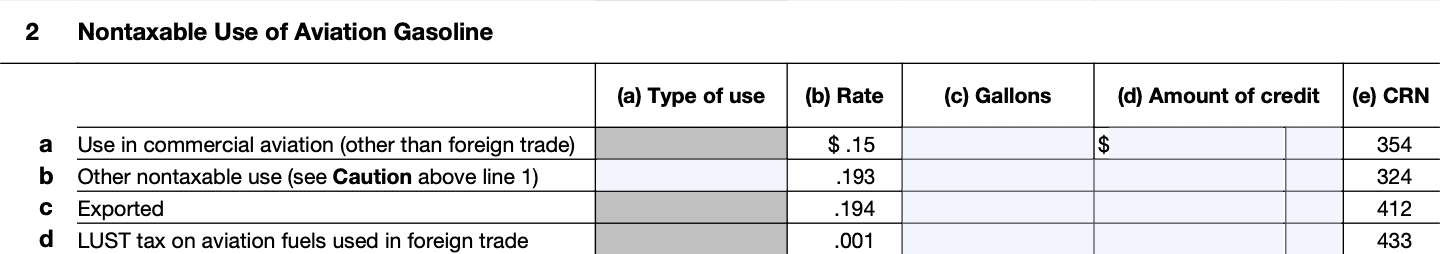

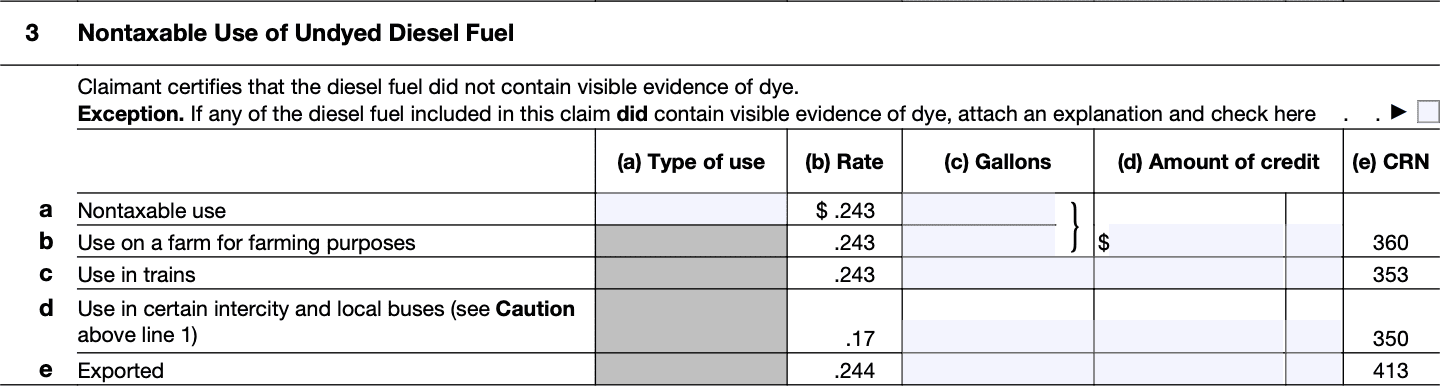

The ultimate purchaser of the diesel fuel is the only person eligible to make this claim.

For each use, enter the following:

In Line 3a, the taxpayer must have used the diesel fuel during the period of claim for one of the following types of use:

For Line 3d, the claimant must not have waived the right to make a claim.

In Line 3e, the taxpayer must have exported the diesel fuel during the period of claim (type of use 3).

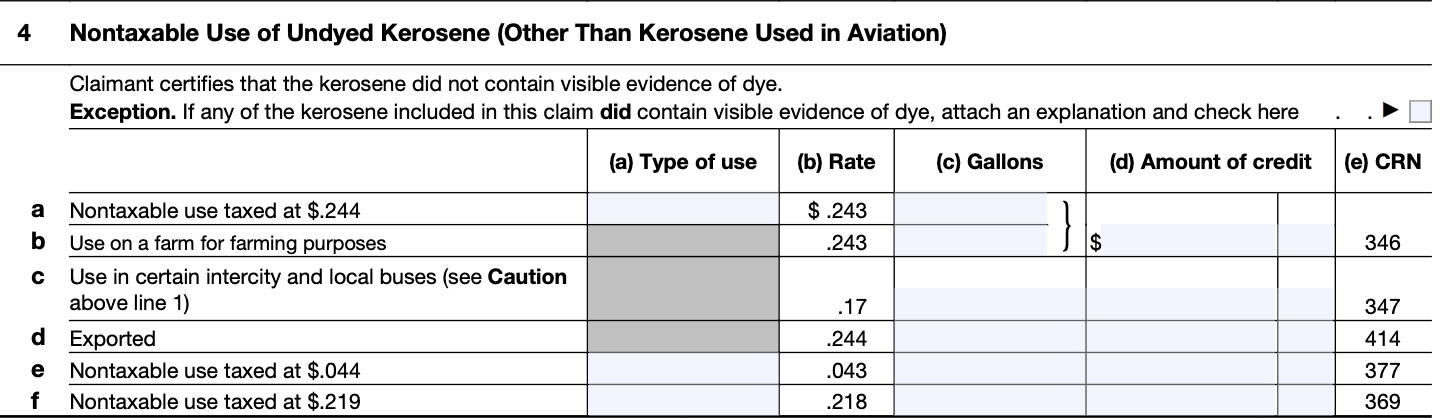

The ultimate purchaser of the kerosene is the only person eligible to make this claim.

For Line 4a, the taxpayer must have used the kerosene during the period of claim for one of the following types of use:

Line 4b does not contain kerosene used in aviation for farming purposes. Instead, use Line 5, Kerosene Used in Aviation, below.

For Line 4d, the taxpayer must have exported the kerosene during the period of claim.

For Lines 4e and 4f, the taxpayer must have used the kerosene during the period of claim for off-highway business use (type of use 2).

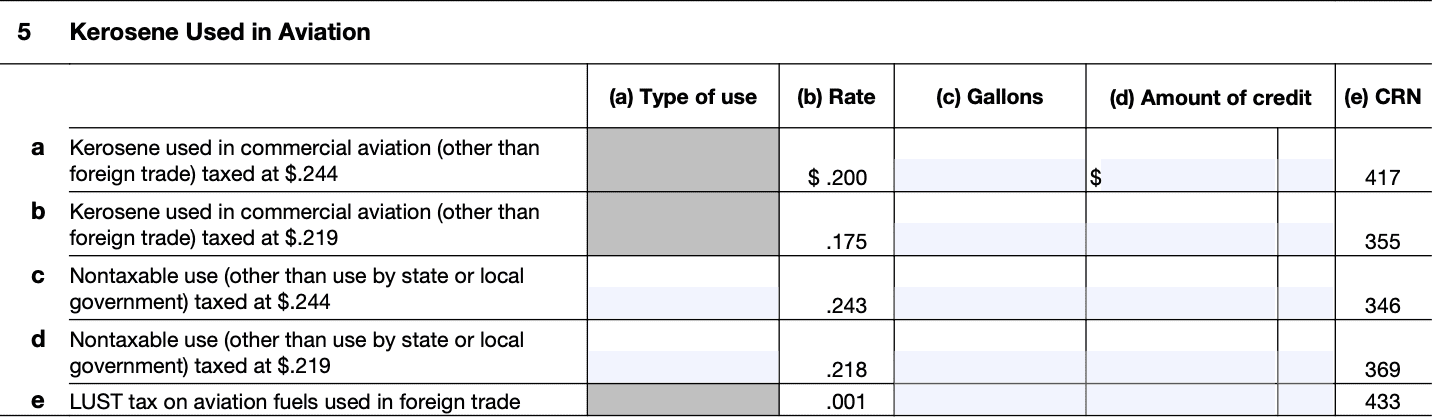

For Lines 5a and 5b, the ultimate purchaser of kerosene used in commercial aviation (other than foreign trade) is eligible to make this claim.

For Lines 5c, 5d, and 5e, the ultimate purchaser of kerosene used in noncommercial aviation (other than nonexempt, noncommercial aviation and exclusive use by a state, political subdivision of a state, or the District of Columbia) is eligible to make this claim.

For Lines 5a and 5b, the taxpayer must have used the kerosene during the period of claim in commercial aviation.

If a taxpayer purchases kerosene partially for commercial aviation use and partially for noncommercial aviation use, Notice 2005-80 applies.

For Lines 5c and 5d, the kerosene must have been used during the period of claim for one of the following types of use:

For Line 5e, the kerosene must have been used during the period of claim for type of use 9. This claim is made in addition to the claim made on Lines 5c and 5d for type of use 9.

Depending on the tax rate of the kerosene, use Line 4a, 4e, or 4f, under Nontaxable Use of Undyed Kerosene (Other than Kerosene Used in Aviation), to make a claim for kerosene used outside the propulsion system of an aircraft.

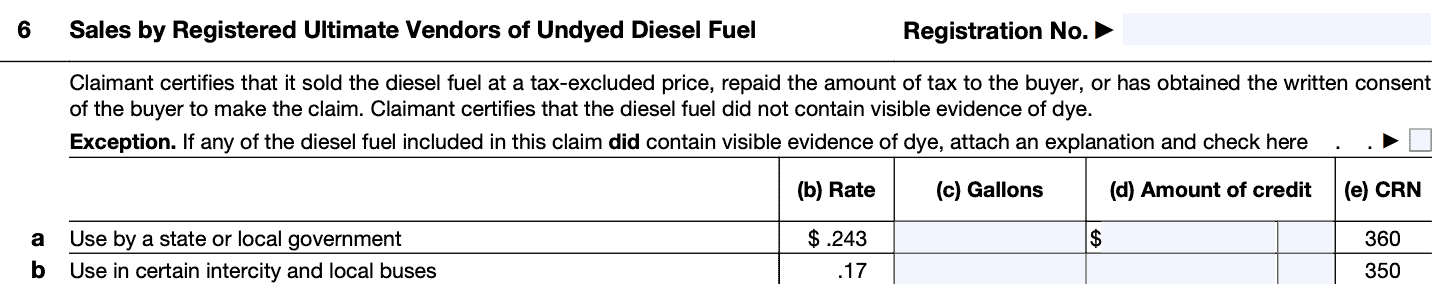

For Line 6a, only the registered ultimate vendor may make this claim. Under Line 6b, the registered ultimate vendor may make a claim only if the buyer waives his or her right to claim. The buyer does this by providing the registered ultimate vendor with an unexpired waiver.

To make an ultimate vendor claim under Line 6, you must have registered using IRS Form 637, Application for Registration (for certain excise tax activities).

Enter your registration number, including the prefix, on the applicable line for your claim.

The taxpayer must have sold the fuel during the period of claim for the exclusive use by one or more state or local governments. This includes essential government use by an Indian tribal government.

For claims on Line 6a, attach a separate statement with the name and TIN of each governmental unit to whom the diesel fuel was sold and the number of gallons sold to each.

IRS rules allow only one claim for each gallon of diesel fuel.

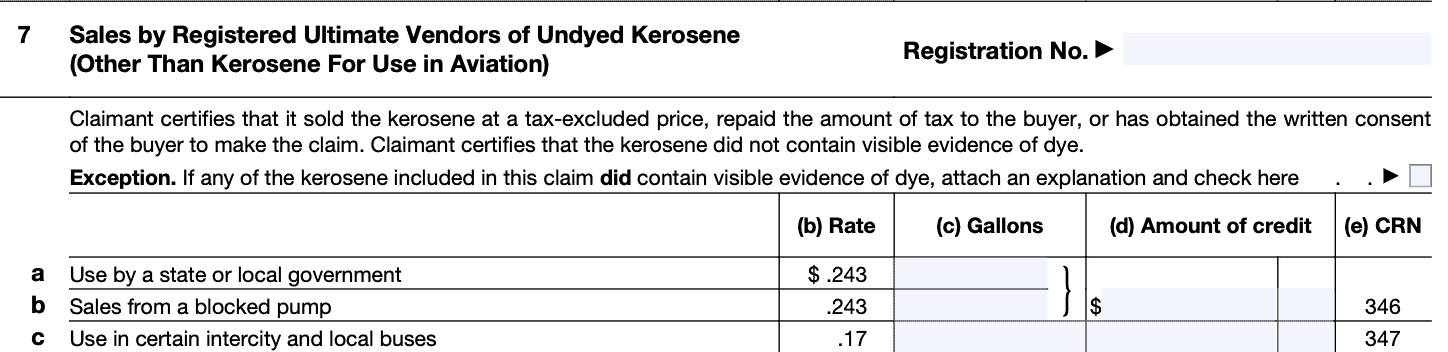

For Line 7a, only the registered ultimate vendor may make this claim. For Line 7b, the claimant must have a statement that contains the following:

Under Line 7c, the registered ultimate vendor may make a claim only if the buyer waives his or her right to claim by providing an unexpired waiver to the vendor.

To make an ultimate vendor claim under Line 7, you must have registered using IRS Form 637, Application for Registration (for certain excise tax activities).

Enter your registration number, including the prefix, on the applicable line for your claim.

Under Line 7a, the taxpayer must have sold the kerosene for use by a state or local government. For Line 7b, the sales must have occurred from a blocked pump.

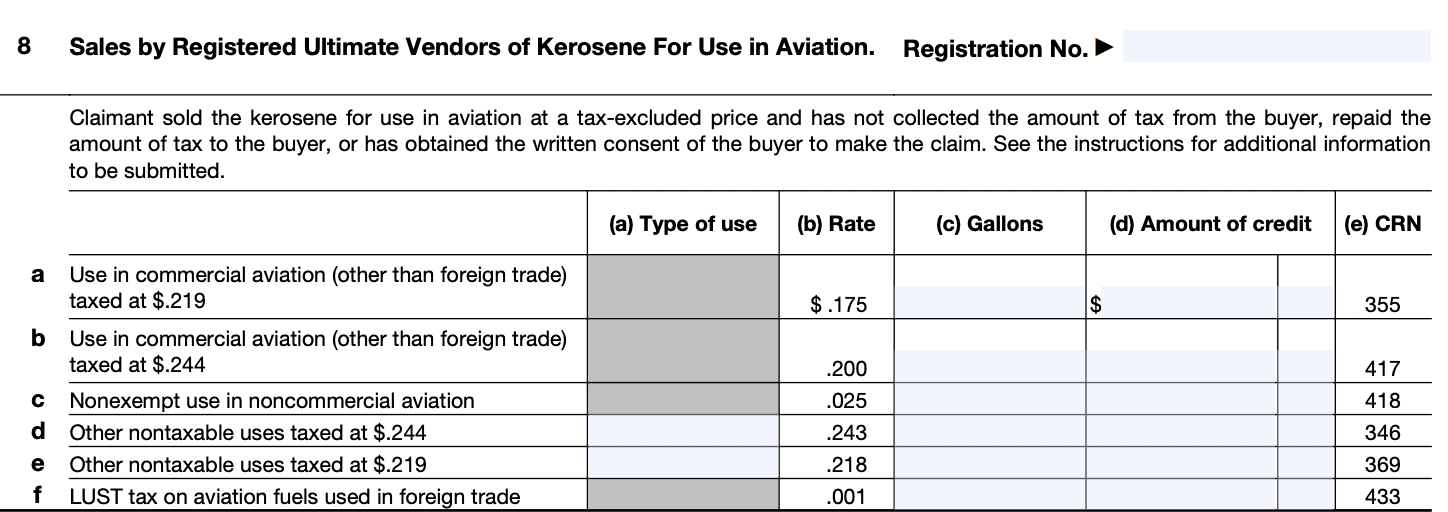

For Lines 8a, 8b, 8d, 8e, and 8f, the registered ultimate vendor of the kerosene sold for use in commercial aviation is eligible to make this claim only if the buyer waives his or her right by providing the registered ultimate vendor with an unexpired waiver. Publication 510 has an example of this waiver in the appendix.

For Line 8c, the registered ultimate vendor of the kerosene sold for use in nonexempt, noncommercial aviation is the only person eligible to make this claim.

To make an ultimate vendor claim under Line 8, you must have registered using IRS Form 637, Application for Registration (for certain excise tax activities).

Enter your registration number, including the prefix, on the applicable line for your claim.

For Lines 8a and 8b, the vendor must have sold the kerosene for use in commercial aviation during the period of claim for use in commercial aviation (other than foreign trade). Under Line 8c, the vendor must have sold the kerosene for a nonexempt use in noncommercial aviation.

For Lines 8d and 8e, the taxpayer must have sold the kerosene for use in noncommercial aviation during the period of claim for one of the following types of use:

In Line 8f, the kerosene must have been sold in foreign trade.

The IRS has kept this line reserved for future use.

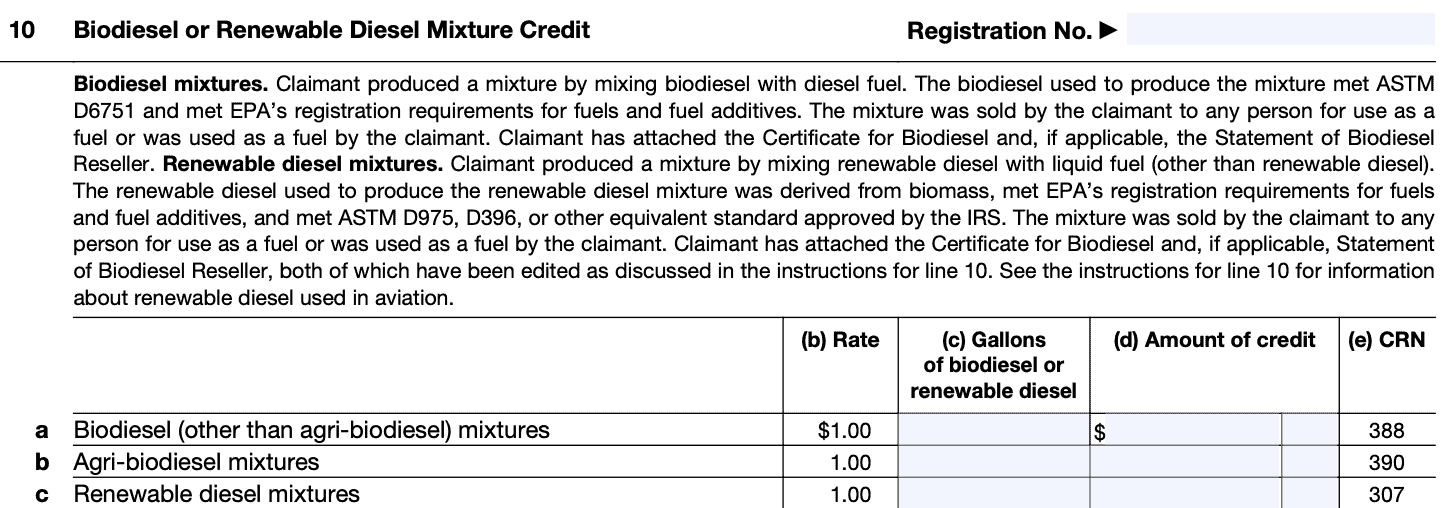

The person that produced and sold or used the mixture in their trade or business is the only person eligible to make this claim. The biodiesel mixture credit is based on the gallons of biodiesel or renewable diesel in the fuel mixture.

Additionally, the biodiesel or renewable diesel must meet certain ASTM and EPA requirements as outlined in the form instructions.

The Certificate for Biodiesel and, if applicable, Statement of Biodiesel Reseller must be attached to the first claim filed that is supported by the certificate or statement. If this isn’t possible, the claimant must attach a separate statement, containing the following:

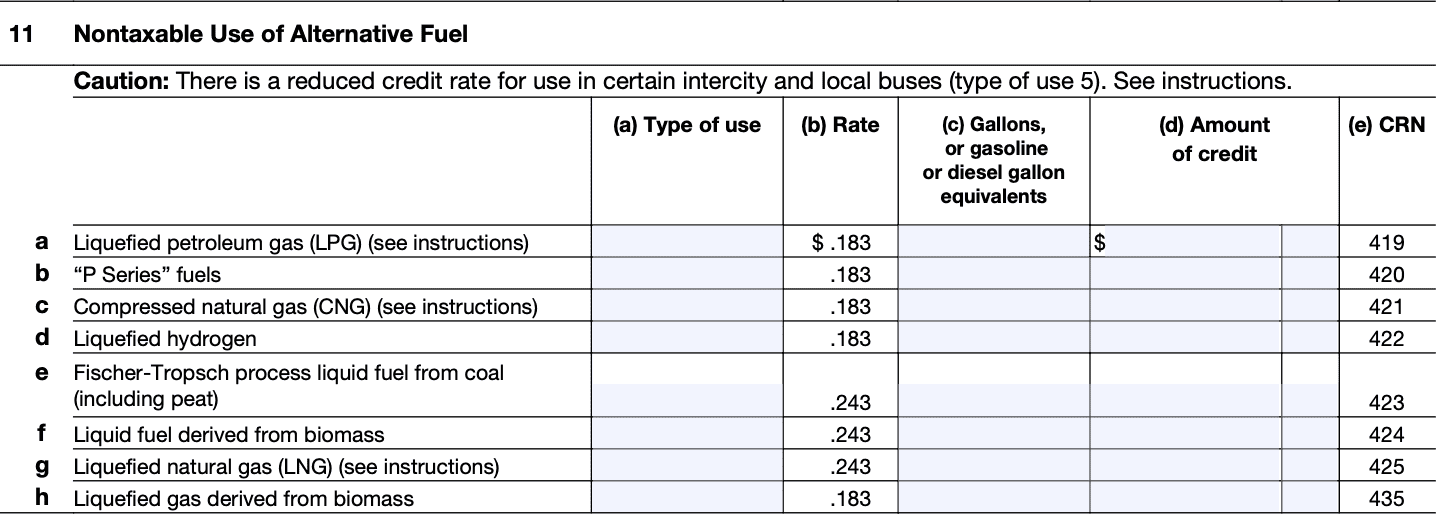

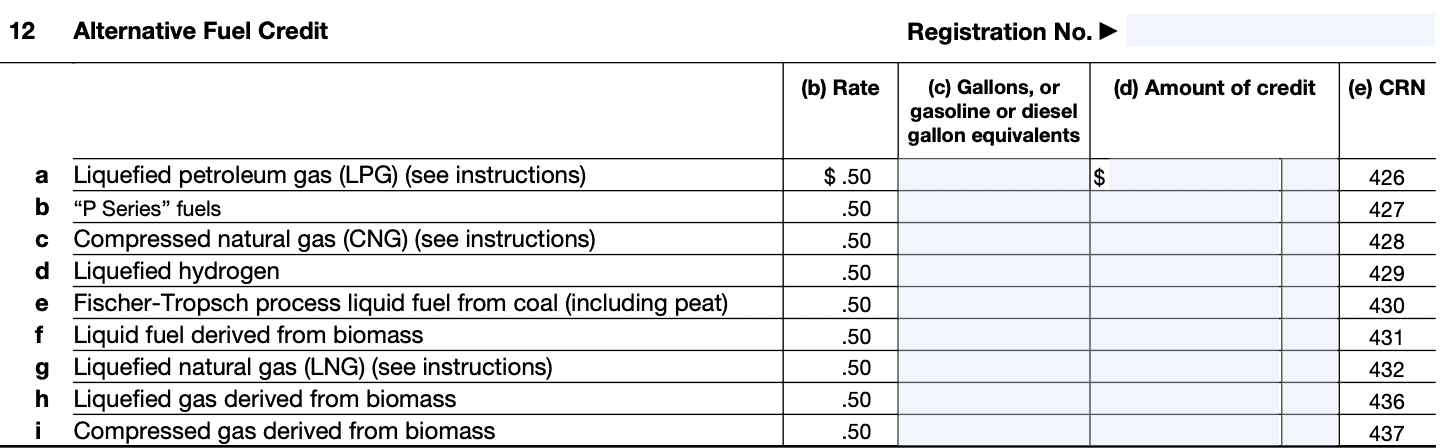

The ultimate purchaser of the taxed alternative fuel is the only person eligible to make this claim under Line 11.

The alternative fuel must have been used during the period of claim for one of the following types of use:

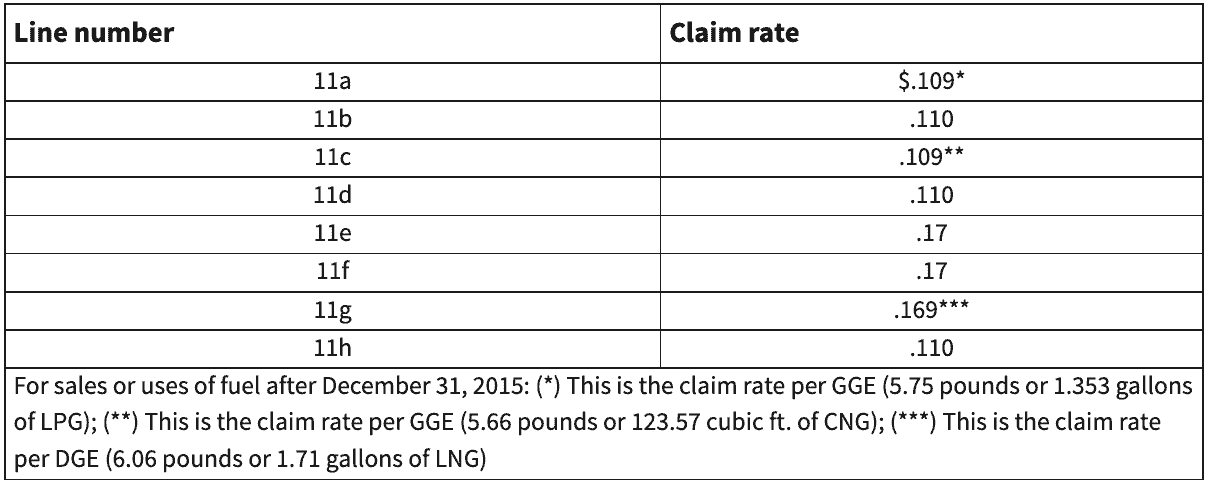

For type of use 5, write ‘Bus’ to the left of column (a), and use the appropriate claim rate outlined below.

Taxpayers cannot claim the alternative fuel mixture credit on this form, only the alternative fuel credit. A taxpayer seeking to claim the alternative fuel mixture credit must file IRS Form 8849, Claim for Refund of Excise Taxes.

Only the following registered alternative fuelers are eligible to make a claim:

Any alternative fuel credit must first be taken on IRS Form 720, Schedule C, to reduce your taxable fuel liability reported on Form 720.

Any excess alternative fuel credit may be taken on:

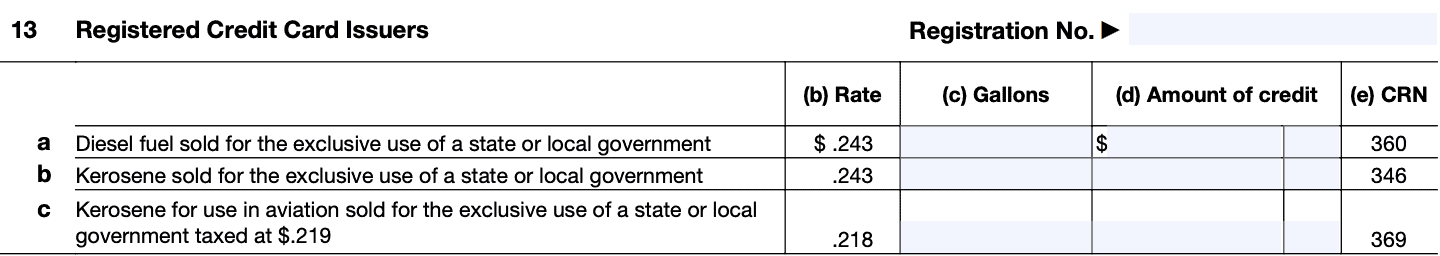

The registered credit card issuer is the only person eligible to make this claim if the credit card issuer:

If any of these conditions is not met, the credit card issuer must collect the tax from the ultimate purchaser. Only the ultimate purchaser can make the claim.

The diesel fuel, kerosene, or kerosene for use in aviation must have been purchased:

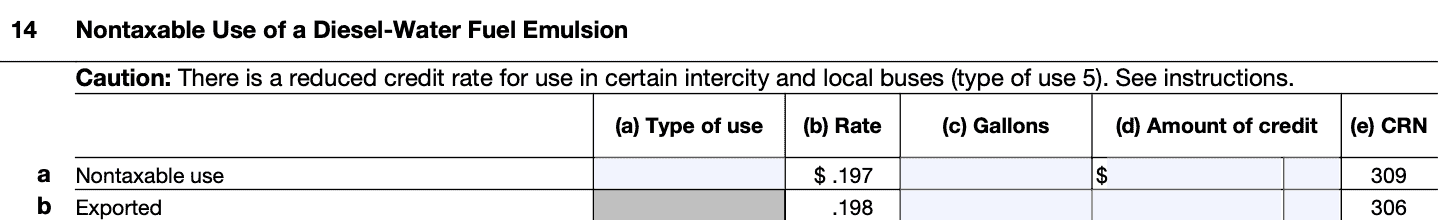

The ultimate purchaser of the diesel-water fuel emulsion is the only person eligible to make this claim.

For Line 14a, the diesel-water fuel emulsion must have been used during the period of claim for one of the following types of use:

For Line 14b, the diesel-water fuel emulsion must have been exported during the period of claim.

If using ‘Type of Use’ 5, do the following:

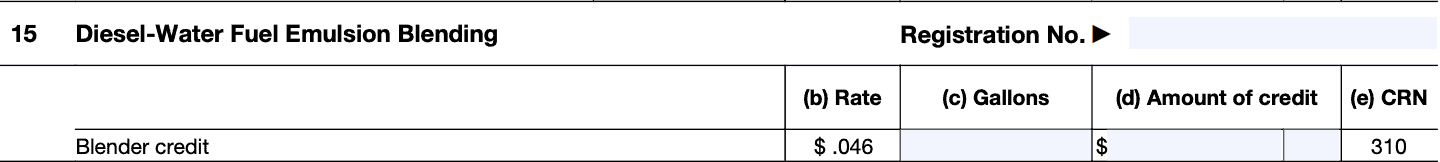

The person that produced (the blender) and sold or used the diesel-water fuel emulsion is the only person eligible to make this claim.

The blender must attach a statement to the claim certifying that:

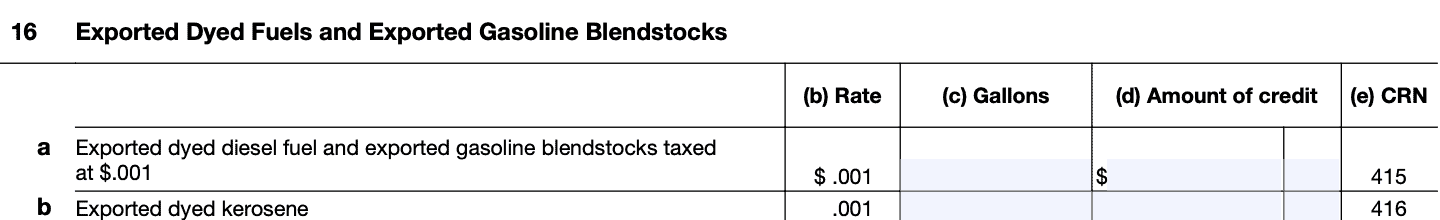

Only the person that exported dyed diesel fuel or dyed kerosene during the period of claim can make this claim.

For Line 17, add the totals of column (d) for Lines 1 through 16. Enter the sum on Line 17 and on the appropriate line as follows:

In the fuel industry, fuel and other petroleum products can be purchased, stored, resold, or transferred many times before becoming consumed. In most cases, the ultimate fuel user is the only entity that can claim a tax credit against their tax bill.

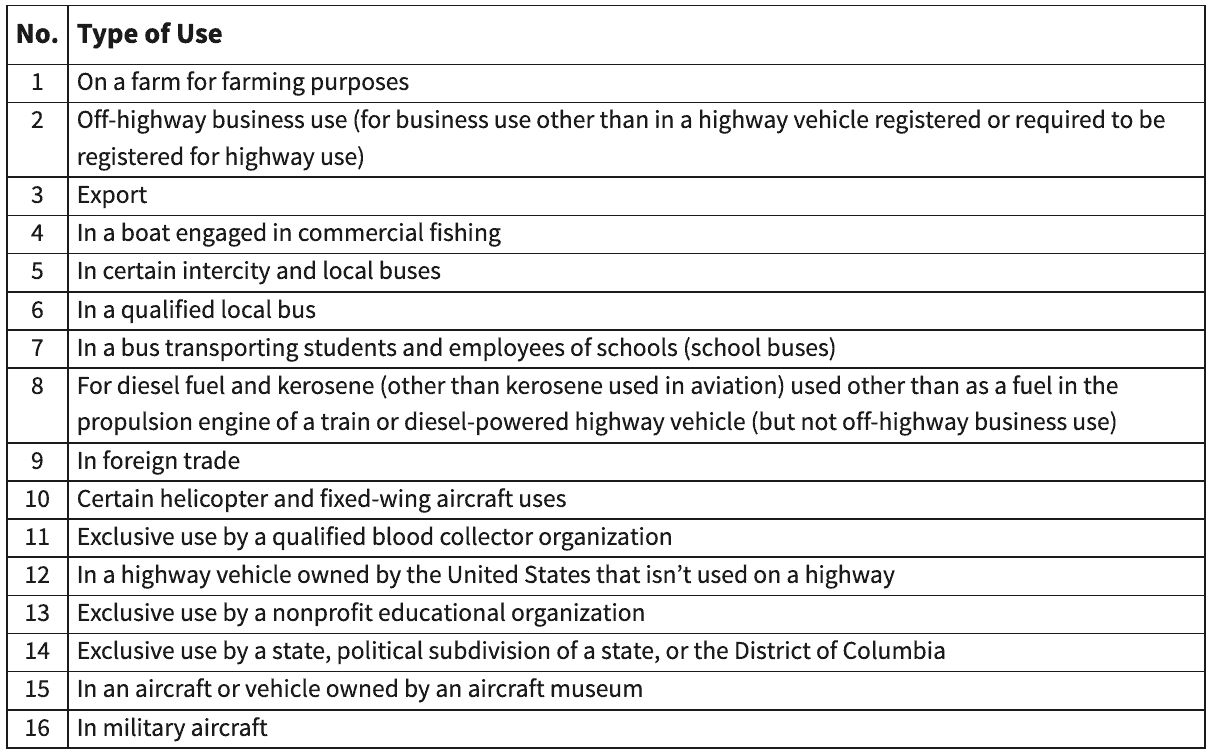

Below is a chart that depicts the qualifying purpose, and a corresponding code that the taxpayer must use on Form 4136.

For example, a horse farmer using fuel on a farm for farming purposes would enter 1 in the Type of use column when filing Form 4136.

Watch this instructional video to learn more about claiming the credit for federal taxes paid on fuels using IRS Form 4136.

IRS Form 4136, Credit for Federal Tax Paid on Fuels, enables certain taxpayers to claim a fuel credit, depending on the type of fuels used, and the type of business use the credit is claimed for.

Do I have to wait for my annual tax return to claim a fuel credit?No. You may claim a refund for excise taxes on IRS Form 8849, or claim credits on your quarterly excise tax return using IRS Form 720. However, you cannot use Form 4136 to claim amounts previously claimed on either Form 8849 or Form 720.

You may download a PDF copy of this form from the IRS website. For your convenience, we’ve enclosed the most recent version of the form below.